Individualization of Financial Sector Services: Trends and Rospatent’s Approaches to Registration of Designations Representing Names of Cryptocurrencies, Crypto Services, Crypto Platforms, and Cryptocurrencу Exchanges as Trade Marks

17 June 2022

Legislative Regulation of Cryptocurrencies in Russia

Rospatent’s Practice in Expert Examination of Designations Representing Names of Crypto Services, Crypto Platforms, Cryptocurrencу Exchanges, or Cryptocurrencies

Among the relatively new and quite complex financial instruments for the Russian market, in the context of a rapidly developing digital economy, it is necessary to distinguish cryptocurrencies, which are of common interest and which have been discussed a lot recently. As per the CoinMarketCap (a popular cryptocurrency data aggregator), there are more than 4,000 different cryptocurrencies in the world now.

In the last year, the world saw a rapid growth of the crypto market. In December 2021, its overall capitalization reached USD2.3 trillion. As per some estimates, Russian individuals’ crypto transactions reach USD5 billion a year. Russian individuals are active users of online platforms trading in cryptocurrencies.

In addition, Russia is among the global crypto mining capacity leaders (as per the report for public consultations entitled “Cryptocurrencies: Trends, Risks, and Measures” issued by the Central Bank of the Russian Federation on 20 January 2022).

It is clear that Russia is one of the key players in the crypto market and the legal regulation of crypto currencies in our country is an inescapable reality and is most vital as never before.

Legislative Regulation of Cryptocurrencies in Russia

On 1 January 2021, Federal Law No.259-FZ dated 31 July 2020 On Digital Financial Assets, Digital Currency, and Amendments to Certain Legislative Acts of the Russian Federation (hereinafter referred to as the “DFA law”) became effective in Russia, which, as per clause 1 of Article 1, “regulates the relations arising during the issue, accounting, and circulation of digital financial assets, specific features of the activities of an operator of the information system that issues digital financial assets and of an operator of the digital financial asset exchange as well as the relations arising during the circulation of a digital currency in the Russian Federation”. Before 1 January 2021, there was no legal definition of a cryptocurrency in the legislation of the Russian Federation, its essence or regulation of issue and circulation were not determined there as well.

What are the key aspects of the DFA law? The first thing that catches the eye in the DFA law is that there is no term “cryptocurrency”. Instead of the usual term “cryptocurrency”, the legislature introduces another term — “digital 2/3 currency”, which, rather than making it clearer as expected, has created some confusion and uncertainty even at a level of the terminology, since a question immediately comes up: are cryptocurrency and digital currency the same thing or not? We can assume that the reason why the law authors have decided to “hide” cryptocurrencies under the term “digital currencies” is their frequent use in criminal activities and criminal schemes, for example, for money laundering or sale of drugs, for which reason the term “cryptocurrency” sounds negative and has a bad reputation, while the term “digital currency” has not smeared its name.

So, a digital currency is a cryptocurrency designation officially approved in the legislation of the Russian Federation. First and foremost, the DFA law clearly separates digital financial assets and digital currencies. As per the DFA law, these are two completely different things. In its current form, the DFA law focuses primarily on the regulation of digital financial assets. Since this article is about cryptocurrencies in their classical meaning, we will not dig into the analysis of digital financial assets but will focus specifically on cryptocurrencies (or digital currencies as per the DFA law).

As defined in the DFA law, a digital currency is a set of electronic data (a digital code or a designation) contained in an information system, which are offered and (or) can be accepted as a means of payment, which is not a currency of the Russian Federation, a currency of a foreign state and (or) an international currency or unit of account, and (or) as an investment, in respect of which there is no person obliged to each owner of such electronic data, except for the information system operator and (or) nodes obliged only to ensure compliance of a procedure for issuing this electronic data and carrying out actions with the same to make (change) records in such an information system with its rules (clause 3 of Article 1 of the DFA law).

In accordance with this definition, a digital currency can include all classic decentralized or pseudo decentralized cryptocurrencies, for example: Bitcoin (BTC), Litecoin (LTC), ZCash (ZEC), Monero (XMR), Ether or ETH (Ethereum blockchain platform’s own cryptocurrency).

Among the key aspects of the DFA law relating to the digital currency, it is worth noting that, despite the fact that a digital currency is classified as a means of payment (which follows from its definition in the DFA law), clause 5 of Article 14 of the DFA law prohibits the acceptance of payment for goods, works, and services in a digital currency in Russia and clause 7 of Article 14 prohibits the dissemination of information about the offer and acceptance of a digital currency as a method of payment for goods, works, and services. It is also worth noting that a digital currency is now officially recognized as property, which allows it to be included in civil transactions.

In addition, the DFA law currently contains no procedure or rules for digital currency transactions, it merely makes a reference to other federal laws that do not exist yet: “The organization of an issue and (or) the issue and (or) the organization of circulation of a digital currency in the Russian Federation shall be regulated in accordance with the federal laws” (clause 4 of Article 14 of the DFA law).

Thus, in its current form, the DFA law is a sort of compromise solution between a complete ban on cryptocurrencies and their full legalization. The DFA law, which adoption has been waited for by the crypto community for about three years, should seemingly have brought legal certainty, after all, in terms of the Russian regulation of cryptocurrencies, but in fact it just has laid the foundations for the regulation of the crypto industry in our country. Currently, in Russia, there is no ban on cryptocurrency as, however, there never has been. You can make any cryptocurrency sale and purchase transactions or pledge, exchange, gift, and bequeath it. It is not quite clear what awaits the crypto market further on. The legislation on the regulation of cryptocurrencies is being elaborated at full speed; however, it is already obvious that the government has come to the conclusion that cryptocurrencies need regulation and strict control, not a ban in any way.

Rospatent’s Practice in Expert Examination of Designations Representing Names of Crypto Services, Crypto Platforms, Cryptocurrencу Exchanges, or Cryptocurrencies

But can there be any difficulties with registration of designations representing the names of cryptocurrencies, crypto services, platforms, and exchanges as trade marks in Russia? Yes, there can be.

Problems have also periodically occurred before the DFA law became effective and they still periodically occur.

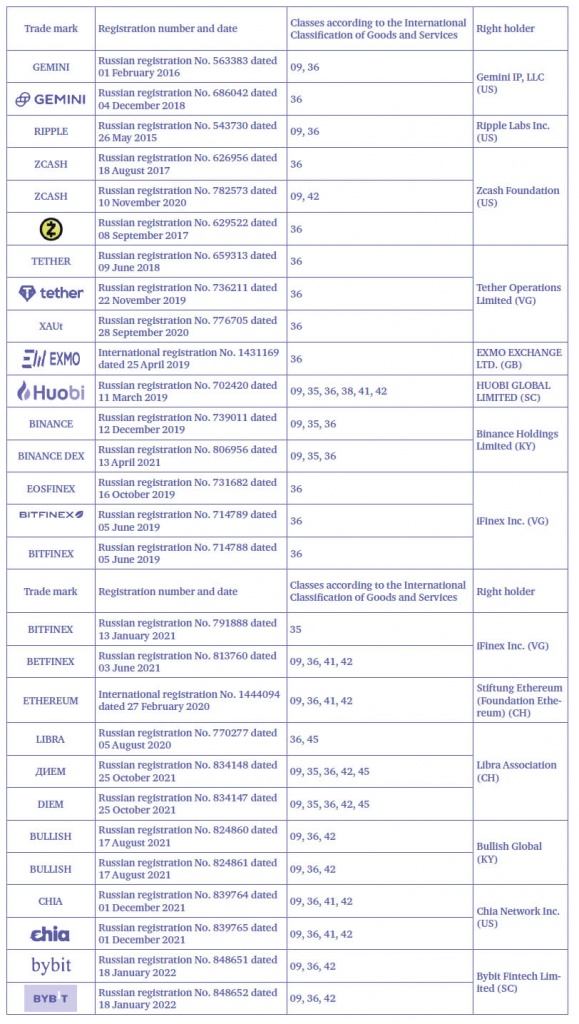

The word “periodically” is used here for a reason since the Rospatent’s position is often inconsistent and unpredictable when registering designations representing the names of cryptocurrencies, crypto services, platforms, and exchanges as trade marks, so it is impossible to assert in advance whether Rospatent will refuse to register such a designation as a trade mark or not. For example, below is a rather extensive list of the trade marks already registered in Russia, which are the names of cryptocurrencies, crypto services, platforms, and exchanges, that have been granted legal protection both before and after the DFA law became effective (the list is not exhaustive):

It is worth noting that the overwhelming majority of the above trade marks have been registered without preliminary refusals to register by the expert examination panels.

However, despite the fact that Rospatent has already registered a considerable number of trade marks containing the names of cryptocurrencies, crypto services, platforms, and exchanges (the above list is not exhaustive) in the name of various right holders, including for the goods and services directly related to the cryptocurrencies (i. e., the lists of goods and services contain items that directly indicate that the right holder’s activities are related to the crypto market, for example: “downloadable computer software for digital currency and cryptocurrency exchange” or “financial exchange services, namely exchange transactions for trading and selling digital currency and cryptocurrency”), the latest practice shows that the probability of Rospatent’s refusal to register such marks is still quite high.

Applicants trying to register trade marks in Russia, which are the names of cryptocurrencies, crypto services, platforms, and exchanges, still periodically face the Rospatent’s refusal to register such designations as trade marks referring to subclause 2 of clause 3 of Article 1483 of the Civil Code of Russia, under which “No state registration of designations representing or containing elements that contradict the public interest, principles of humanity and morality as trade marks is allowed”. The expert examination panel’s arguments are:

- The claimed designation is the name of a crypto service or the name of a cryptocurrency;

- As per the press centre of the Central Bank of Russia, due to the lack of security and legally binding entities, transactions in “virtual currencies” are speculative. The Bank of Russia warns that the provision by legal entities of services in the exchange of “virtual currencies” for Russian rubles and foreign currencies as well as for goods (works, services) will be considered as potential involvement in shady transactions in accordance with the legislation on anti-money laundering and combating the financing of terrorism.

As a source, the expert examination panel refers to the press releases of the Bank of Russia "On the Use of “Virtual Currencies”, in particular, Bitcoin in Transactions" dated 27 January 2014 and "On the Use of Private “Virtual Currencies” (Cryptocurrencies)" dated 4 September 2017.

In this regard, the claimed designation cannot be registered as a trade mark (service mark) based on the provisions provided for in clause 2 of clause 3 of Article 1483 of the Civil Code of Russia, since such registration of the designation as a trade mark (service mark) and its use in civil transactions as a means of individualization of goods and (or) services are qualified by the expert examination panel as contradicting the public interest.

The press releases of the Bank of Russia "On the Use of “Virtual Currencies”, in particular, Bitcoin in Transactions" dated 27 January 2014 and "On the Use of Private “Virtual Currencies” (Cryptocurrencies)" dated 4 September 2017 referred to by Rospatent are issued as press releases by the press centre of the Bank of Russia, are not signed by anyone, are not registered and, accordingly, cannot be considered as regulations binding upon federal state authorities, state authorities of constituent entities of the Russian Federation and local authorities, all legal entities and individuals, since such regulations must be issued in the form of directions, statutes, and instructions and must be duly registered (Article 7 of Federal Law No.86-FZ dated 10 July 2002 (as amended on 30 December 2021) On the Central Bank of the Russian Federation (Bank of Russia) (as amended, effective from 11 January 2022)). Thus, the press releases always referred by Rospatent in support of its refusal under subclause 2 of clause 3 of Article 1483 of the Civil Code of Russia cannot be legally considered to have legislative effect or to be applicable when interpreting the legislation, for which reason it can be concluded that there is no regulatory position of the Bank of Russia on this issue.

In addition, these press releases do not contain any direct statements that cryptocurrencies are quasi-money and are banned in Russia, on which basis the expert examination panel could qualify the registration of designations representing the names of cryptocurrencies, crypto services, platforms, and exchanges as a trade mark and their use in civil transactions as means of individualization of goods and (or) services as contradicting the public interest, and that the registration and use of such trade marks may result in a violation of the legislation of the Russian Federation in other areas of legal regulation. Moreover, in its press release dated 4 September 2017, the Bank of Russia even reports that “along with interested federal state authorities, the Bank of Russia monitors the crypto market and develops approaches to the definition and regulation of cryptocurrencies in the Russian Federation”, thereby indicating the government’s intent to put the crypto market in order at the legislative level in the near future.

Thus, it seems that the above press releases of the Bank of Russia cannot be sufficient to support the Rospatent’s position when making decisions about the contradiction of designations representing the names of cryptocurrencies, crypto services, platforms, and exchanges to the Russian public interest.

In addition, as per the draft law on the regulation of cryptocurrencies brought by the Ministry of Finance of Russia in the Government of Russia on 18 February 2022, which has been prepared based on the previously approved Framework of Legislative Regulation of Mechanisms for Organizing the Circulation of Digital Currencies, the changes proposed in the draft law are aimed at forming a legal market for digital currencies establishing the rules for their circulation and pool of members (more details on the Ministry’s website). The new draft law explicitly indicates the government’s position aimed at legalizing the crypto market, not completely banning. Thus, such designations cannot contradict the public interest, since the balanced position of the official Russian government, reflecting the public sentiment, as we see, is in no case aimed at banning the circulation of cryptocurrencies; on the contrary, the official government is after legalizing and streamlining relations in the crypto market.

It is also worth noting that the rule of law specified as a ground for refusal to register designations, namely, subclause 2 of clause 3 of Article 1483 of the Civil Code of Russia, provides for contradiction to the public interest of the designation itself or its elements.

As a rule, the names of cryptocurrencies, crypto services, platforms, and exchanges are either fantasy words, such as BINANCE or ETHEREUM, or words that are semantically neutral with respect to the goods and services related to cryptocurrencies, such as RIPPLE or GEMINI.

Obviously, such designations for goods and services related to a cryptocurrency cannot actually contradict the public interest, since they contain neither direct nor associative calls for purchase or use of cryptocurrencies in transactions, do not form positive attitude to cryptocurrencies, have no offensive meaning, etc. In other words, it is apparent that such designations themselves do not contradict the legal foundations of public order and cannot cause any negative associations with the goods and services for which the protection of designations is claimed. In fact, this is confirmed by the position of Rospatent itself that has registered both these particular marks and other marks, including for the goods and services related to a cryptocurrency.

If you follow the Rospatent’s logic, the expert examination panel should also refuse to register trade marks representing the names of tobacco or alcoholic beverages based on contradiction to the public interest just because there are a number of restrictions related to tobacco smoking, consumption of nicotine containing products and alcoholic beverages, and their sale under the current legislation in Russia.

The court practice of challenging the Rospatent’s decisions to refuse to register designations representing the names of cryptocurrencies, crypto services, platforms, and exchanges as trade marks based on subclause 2 of clause 3 of Article 1483 of the Civil Code of Russia is too small and is limited to two decisions of the Intellectual Property Rights Court dated 10 September 2021 in case No. SIP‑387/2021 and dated 31 January 2022 in case No. SIP‑386/2021. Both cases involve parallel applications in the name of one applicant: No. 2019721082 for classes 09, 35, 38, and 42 and No.2019721067 for class 36. At the same time, it is worth noting that the applicant’s activity is not related to cryptocurrencies and the claimed goods and services do not contain any items directly related to cryptocurrencies but, according to the information found by the expert examination panel on the Internet, the claimed designations include a designation that is the name of a cryptocurrency, for which reason it has been refused to register the claimed designations, including based on subclause 2 of clause 3 of Article 1483 of the Civil Code of Russia with references to the above press releases of the Bank of Russia.

In the above decisions of the Intellectual Property Rights Court, the judicial chamber concludes that the Rospatent’s conclusion on the contradiction of the designations, claimed for registration and containing the name of a cryptocurrency, to the public interest is not grounded enough, since Rospatent has not provided the reasons how the registration of the claimed designations for individualization of particular goods and services of classes 9, 35, 36, 38, and 42 according to the International Classification of Goods and Services will be perceived as contradicting the public interest. The court also “draws special attention to the inconsistent position of Rospatent when analysing the designations containing the name of cryptocurrencies for compliance with subclause 2 of clause 3 of Article 1483 of the Civil Code of Russia” noting that “Rospatent has registered trade marks containing the names of cryptocurrencies in the name of various right holders for various goods and services, including financial services of class 36 according to the International Classification of Goods and Services”.

Also, the judicial chamber “takes into account that the records on each application are kept independently, while this circumstance does not exempt Rospatent from its obligation to take into account the decisions already taken in similar or same situations” and notes that “when refusing to register the disputed trade mark, Rospatent has not reasoned the existence of circumstances serving as a basis for making a different decision” pointing out that “state authorities are obliged to perform the functions imposed on them subject to the principle of protection of legitimate expectations.

Predictable behaviour of a state authority that has official power is one of the factors that control the arbitrary rule, create conditions for implementing the principle of legal certainty, and contribute to forming trust in the law and state actions among parties to legal relations”.

It is noteworthy that “in the court session, the Rospatent’s representative has explained in response to the court’s question that the applicants may have provided documents on the admissibility of such registration during other registrations of the trade marks, which include the names of cryptocurrencies”.

The court has objected to this statement that the arguments not documented cannot be taken into account and also has noted that “the contradiction of the designation to the public interest is an absolute ground for refusal to register the trade mark if the relevant circumstances are revealed; in connection with the above, it is impossible to overcome the ban on such registration by providing authorization documents”.

Thus, the court has concluded that “the Rospatent’s conclusions that the claimed designation contradicts the public interest do not comply with the current legislation and the registration practice of the administrative authority”.

It is worth noting that, unfortunately, the lawfulness of Rospatent’s use of references to the above press releases of the Bank of Russia in support of the refusals to register designations under subclause 2 of clause 3 of Article 1483 of the Civil Code of Russia has not been challenged by the claimant and has not been considered in these cases by the court.

It is noteworthy that Rospatent has filed a cassation appeal against the decision of the Intellectual Property Rights Court dated 10 September 2021 in case No. SIP‑387/2021; however, Rospatent does not challenge in it the above court’s conclusions on subclause 2 of clause 3 of Article 1483 of the Civil Code of Russia (note that the subject matter of consideration of the cassation appeal is the court’s conclusions on other grounds for refusal). We can only assume that Rospatent has no arguments other than those previously presented, for which reason Rospatent has concluded that it has been futile to challenge the court decision in this part. As a result, the cassation appeal filed by Rospatent has been dismissed.

Despite the position already indicated by the court regarding the Rospatent’s conclusions that the designations claimed for registration and containing the name of the cryptocurrency contradict the public interest, Rospatent still refuses to register such designations as trade marks based on subclause 2 of clause 3 of Article 1483 of the Civil Code of Russia. In such cases, in its decisions on international applications, Rospatent does not even refer to the press releases of the Bank of Russia but simply indicates that the claimed designation contradicts the public interest since it is the name of a cryptocurrency, which circulation is not allowed in Russia, referring to the official website of the Bank of Russia www.cbr.ru. Perhaps the Rospatent’s position is that if something is not yet allowed at the legislative level, then it should be considered as banned. However, this position is not unchallengeable. The legislation actually cannot and should not describe all possible things and actions with the same, unless certain activities or operations with certain things require special regulation or banning.

The only thing prohibited by the effective DFA law with regard to cryptocurrencies is to accept payment for goods, works, and services in a digital currency (cryptocurrency) in Russia and to disseminate information about the offer and acceptance of a digital currency as a method of payment for goods, works, and services in Russia. At the same time, under the DFA law, the organization of an issue and (or) the issue and (or) the organization of circulation of a digital currency in the Russian Federation will be regulated in accordance with the federal laws, which are currently being actively prepared. In addition, the Russian Government is not considering the option of banning cryptocurrency. It is obvious that the official website of the Bank of Russia, to which Rospatent refers as the source, contains no information that the cryptocurrency circulation in Russia is not allowed or banned.

Summing up the above, the Rospatent’s arguments that designations containing the name of cryptocurrencies, crypto services, platforms, and exchanges contradict the public interest based on the apparently outdated press releases of the Bank of Russia, which, apart from not being bank regulations, do not either correspond to the current plans of the Russian government aimed at forming a legal crypto market and not at their banning, or even based on an entirely unclear statement that the crypto circulation in Russia is not allowed, can be considered as ungrounded and unlawful. Moreover, the Rospatent’s position is at variance with the position of the Russian Government, which, as mentioned above, does not consider the option of banning cryptocurrency in Russia.

It is also worth noting that Rospatent, along with refusing to register designations containing the name of cryptocurrencies, crypto services, platforms, and exchanges based on their contradiction to the public interest, has increasingly begun to ground its refusals also on the impossibility to fix the exclusive right to cryptocurrency names because they can be used by the general public as a means of payment, but it is yet probably too early to say that this trend of Rospatent becomes sustainable. In any case, whether such a ground for refusal is lawful or not should be separately analysed and such an analysis can be performed in an individual article.